Lesson 2: Finance: Reporting Rhythm, Part 1

“A map does not just chart, it unlocks and formulates meaning; it forms bridges between here and there, between disparate ideas that we did not know were previously connected.” — Reif Larsen

Welcome to Lesson 2 of the B-Tribe Business Mastery Program.

In his excellent book Simple Numbers, Greg Crabtree refers to the process of monitoring business metrics as “Reporting Rhythm.” We like this term, as it implies you need to regularly, consistently monitor your metrics. Just like a heartbeat, reviewing your metrics needs to be regular and consistent to be healthy.

In this lesson, which is part 1 of 3, we discuss the financial metrics you need to be monitoring on a regular basis.

It’s quite extraordinary that only a small percentage of businesses monitor and review their financial metrics on a regular basis. Most look at them at the end of the financial year, or quarterly at best, by which time the damage has been done and opportunity for improvement passed.

Establishing a Reporting Rhythm is the most critical action you can take in your business.

Your metrics inform you:

- What needs to be improved

- Where you need to focus your attention

- Whether you are progressing toward or away from your goals.

If you don’t establish a Reporting Rhythm, you will likely:

- Put your focus and energy in the wrong areas

- Be unproductively busy

- Be drawn into low value tasks

- Become an “employee” of the business rather than the “owner”

- Be unaware of destructive forces within the business

- Not know when you’re going backwards until it’s too late.

Results Metrics

We refer to financial metrics as “results” metrics because they report financial outcomes – the results or effects – of your management actions.

Outcomes don’t just randomly occur. They are the direct culmination of all the management decisions and actions you as owner implement.

“Results Metrics” measure the outcomes of your actions over the period of time. The most commonly reported metrics include the Profit & Loss, Cashflow Statement and Balance Sheet.

Owners are often remiss in reviewing their financial metrics. They feel that because they work “hard” the numbers on the page should resultantly reflect positively. It doesn’t work that way! As the owner it’s your duty to review the numbers; and to use those numbers to inform where you need to invest your energy and attention.

In this lesson we review the main reports – with a few tweaks to make them more informative and useful.

Just as the “results” metrics report outputs; we also need to report inputs, or your “activity” metrics. Your “Activity Metrics” represent the various inputs you have instigated through your management action. We review these in Part 2.

What to Report

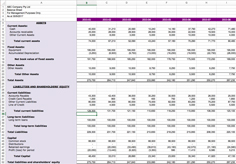

The most common reports are your Profit & Loss (P&L), Cashflow Forecast and Balance Sheet.

Why are they important?

Your P&L and Cashflow Forecast report outcomes over a period of time. For instance, you could review your monthly P&L and Cashflow.

Your Balance Sheet represents a snapshot in time. For instance, you could review your balance sheet as at a certain date and compare it to another date – i.e. beginning and end of the financial year; or quarter.

Many business owners get confused between their P&L and Cashflow. They are not the same. The P&L is a theoretical report. The Cashflow is a real report.

All three (3) reports are connected. Your Net Profit reflected on your P&L; and your Cash reflected on your Cashflow, both become Balance Sheet items.

Hence it’s important you review all three reports as part of your Reporting Rhythm.

We provide templates of the reports for you to download and use below.

Trend Analysis

There’s limited value in reviewing reports in isolation.

You need to know which way your business is heading – toward or away from your goals. Business metrics and financial intelligence start with multiple points of comparison over numerous time periods. And the trend analysis is the first component of business intelligence.

For instance, you need to know how this quarter compares to last quarter; and to the same quarter last year. This is Trend Analysis. It indicates trends in your business. And it’s crucial in terms of informing business strategy.

Rolling-Twelve

A trend analysis metric we like (again, from the book Simple Numbers by Greg Crabtree) is the “Rolling-Twelve”.

The rolling-twelve is a P&L that shows every month ending a 12-month accounting period. When you compare the twelve-month periods side by side, you gain a powerful macro view of your business performance.

Common Size (CS)

The “common size” technique is a view of your financial metrics in percentages.

For instance, common sizing your P&L means converting all your monetary amounts into percentages. If revenue is $1,000,000 and cost of goods sold (COGS) is $500,000; your COGS is 50% of revenue. If your rent is $50,000, then rent represents 5% of revenue; and if wages is $100,000, it represents 10% of revenue, and so on.

The common size technique is extremely powerful. When your numbers are converted to percentages it emphasises which items need focus. It provides a “force multiplier,” by allowing you to identify areas in your business where you can gain maximum upside advantage. For instance, if you notice two areas that can be improved for approximately the same effort, and one reflects 7% of revenue and the other 0.5% of revenue, you know where best to invest your energy.

The common size technique is also an effective way to compare business units, such as franchises, stores or branches.

Dollars Per Unit (DPU)

The final reporting technique you should use is “dollars per unit.” The dollars per unit technique divides your numbers by a “per unit” measure applicable to your business.

For instance, let’s say your business is in education. You may divide every line item by the number of students in the period. Or if you owned a restaurant, you may divide every line item by the number of customers served in the period.

Seeing your numbers on a per-unit basis allows you to immediately focus in on areas you can tweak for improvement. Knowing that you’re spending $27 per unit on labour, or $18 per unit on rent is immensely more powerful than simply seeing a grossed-up line item of “$52,927.”

Sales & Productivity (S&P) Report

It’s important to keep your finger on the pulse when it comes to sales. Whilst many retailers monitor sales on a daily basis, for most businesses weekly is fine.

It’s also important to tie in labour efficiency to sales. Labour efficiency is your gross profit per labour dollar.

For instance, let’s say your gross profit before labour came out was 50% of sales. So if you had $40,000 in sales for the week, you had $20,000 in non-labour gross margin, which is the term we use for the cost of gross profit before any labour has come out.

If your goal was to have a labour efficiency of 2.0, your weekly payroll needs to be $10,000.

Keep in mind this is all labour, not just productive labour. It includes all officer and management staff, not just sales staff.

In this example, if weekly payroll was $12,000, it would have been higher than the labour efficiency target and you’d need to ascertain if that was a weekly anomaly or if something more serious needs to be actioned.

A Sales & Productivity Report template is available from the Template section below.

Here’s an example of a weekly Sales and Productivity Report:

| Exhibit 8.3: Sales and Productivity Report | ||||||||

|---|---|---|---|---|---|---|---|---|

| Labour Efficiency Ratio | ||||||||

| Period | GP% | Sales | GP$ | Cost of Labour | Week | MTD | YTD | |

| January | 49.50% | $145,000 | $71,775 | $35,000 | $2.05 | $2.05 | ||

| February | 51.20% | $145,000 | $71,775 | $35,000 | $2.05 | $2.05 | ||

| March | 47.60% | $145,000 | $71,775 | $35,000 | $2.05 | $2.05 | ||

| April | 40.10% | $145,000 | $71,775 | $35,000 | $2.05 | $2.05 | ||

| May | ||||||||

| Week 1 | 50.00% | $40,000 | $20,000 | $10,000 | $2.00 | $2.00 | $2.14 | |

| Week 2 | 50.00% | $38,000 | $19,000 | $9,500 | $2.00 | $2.00 | $2.14 | |

| Week 3 | 50.00% | $35,000 | $17,500 | $11,000 | $1.59 | $1.85 | $2.10 | |

| Week 4 | 50.00% | $1.85 | $2.10 | |||||

| Week 5 | 50.00% | $1.85 | $2.10 | |||||

| May Total | $113,000 | $56,500 | $30,500 | $1.85 | $2.10 | |||

What Reports & When

We know this seems like a lot of reporting. And it may be a big leap from where you are now. But if you’re serious about your business success, you need to implement a consistent and recurring Reporting Rhythm by which to inform your management strategy.

Here we break down the reports and a Reporting Rhythm for you.

| Weekly | Monthly (Within 5-days of End of Month) | Quarterly (Within 5-days of End of Quarter) |

|---|---|---|

|

|

|

Remember, these are just the “results” side reports. In Part 2 we discuss the “activity” or input side reports.

To assist you implement these reports we provide an integrated reporting template below.

Actions

- Using the template above, confirm what your Reporting Rhythm will be

- Identify who will be responsible for all the actions comprising your Reporting Rhythm

- Meet with, train and delegate to, all team members with responsibilities

- Schedule deadlines and meetings for ALL Reporting Rhythm activities, forward 12-months.

Worksheet

Financial Metrics Worksheet

Not registered for the free 52-week Business Mastery Program?

Register HereShare this concept

https://www.btribe.com.au/business-mastery-program/reporting-rhythm-part-1

© Copyright B-Tribe Pty Ltd ABN 82 091 748 088.

Disclaimer: The content presented herein is for general information purposes only. It is not intended to replace or usurp professional services advice. B-Tribe Pty Ltd is not a legal or accounting or business coaching entity. Application of any content and or resources provided by B-Tribe Pty Ltd by the reader is done so solely at their risk.

Not registered for the free 52-week Business Mastery Program?

Register NowShare this concept

https://www.btribe.com.au/business-mastery-program/reporting-rhythm-part-1